ABN AMRO - Personal Loan

At ABN AMRO I was the UX Designer of Consumer Credits within the Daily Banking team for two years, during this time I was responsible for all research, design and optimisation work of application flows, product overview pages and change processes within the domain of Consumer Credits.

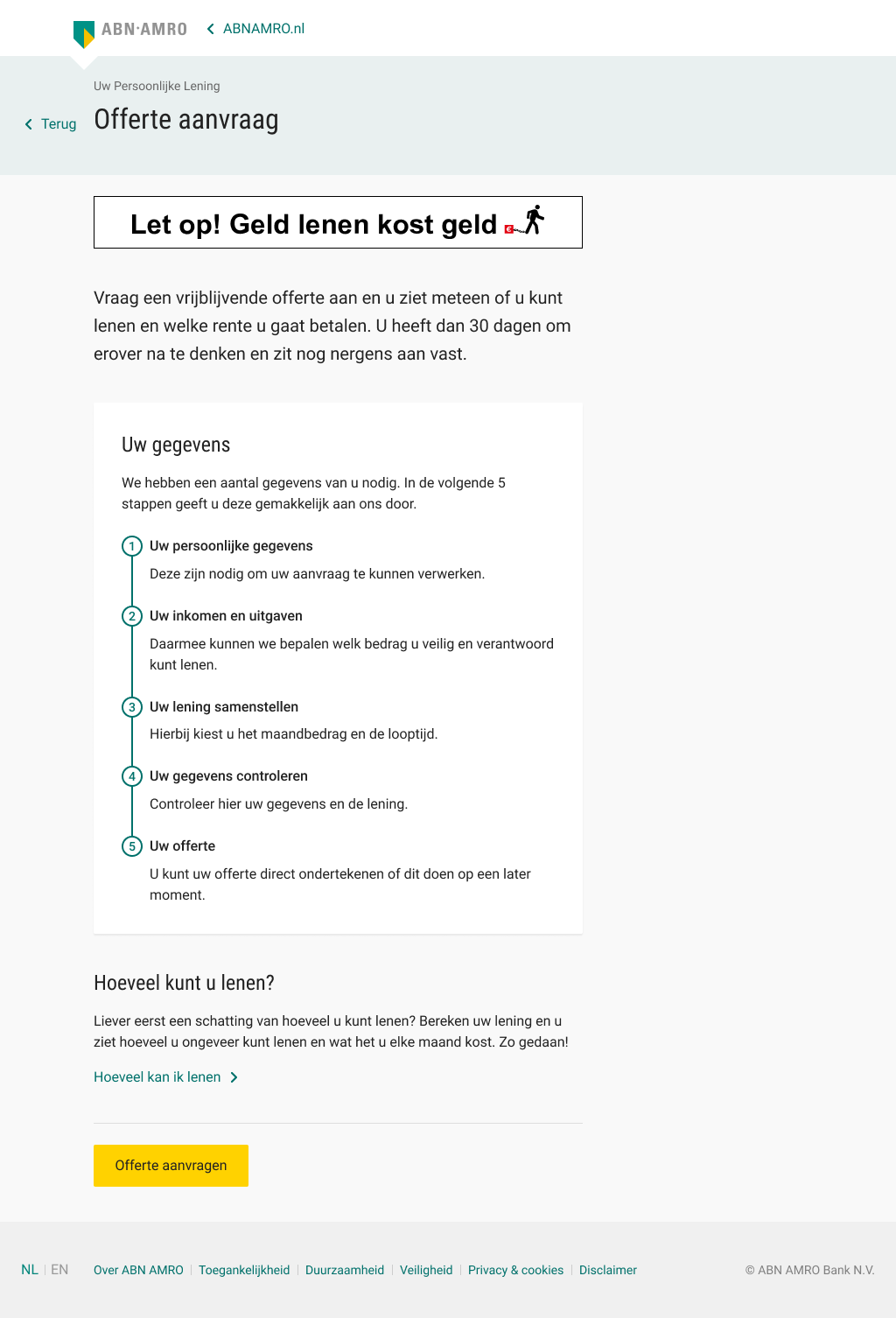

Within the application flow for a Personal Loan there was a decrease in conversion. The challenge for me was to discover where the issues were and what the customer churn caused.

My Role

As the UX designer I primarily worked on Interaction and UI design, and on the user testing and interviews.

Goal

People loan money for several reasons, for some it is for something that brings joy, for others it is because they have financial problems.

- To create an effortless and simple application flow

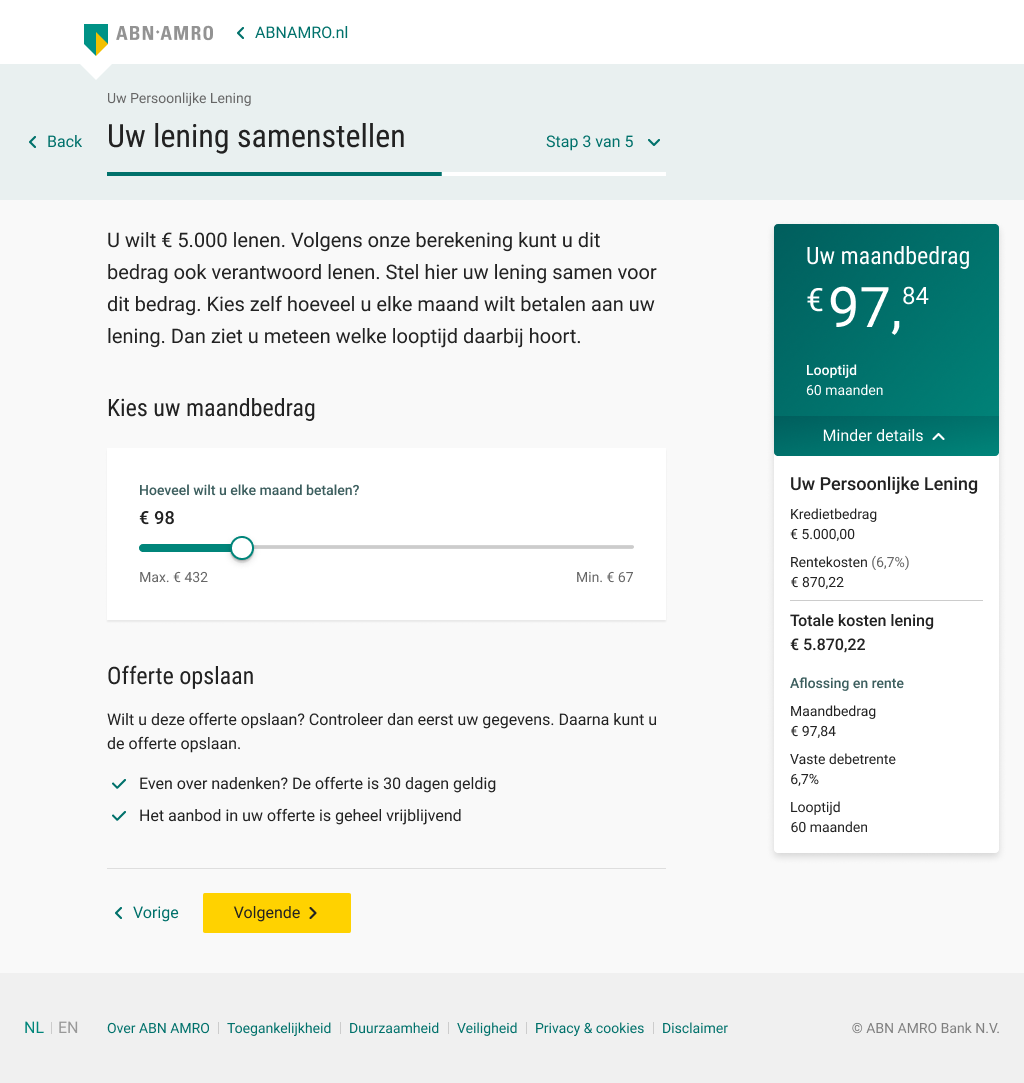

- To give detailed insight what a loan costs

- To provide a loan offer that is accurate

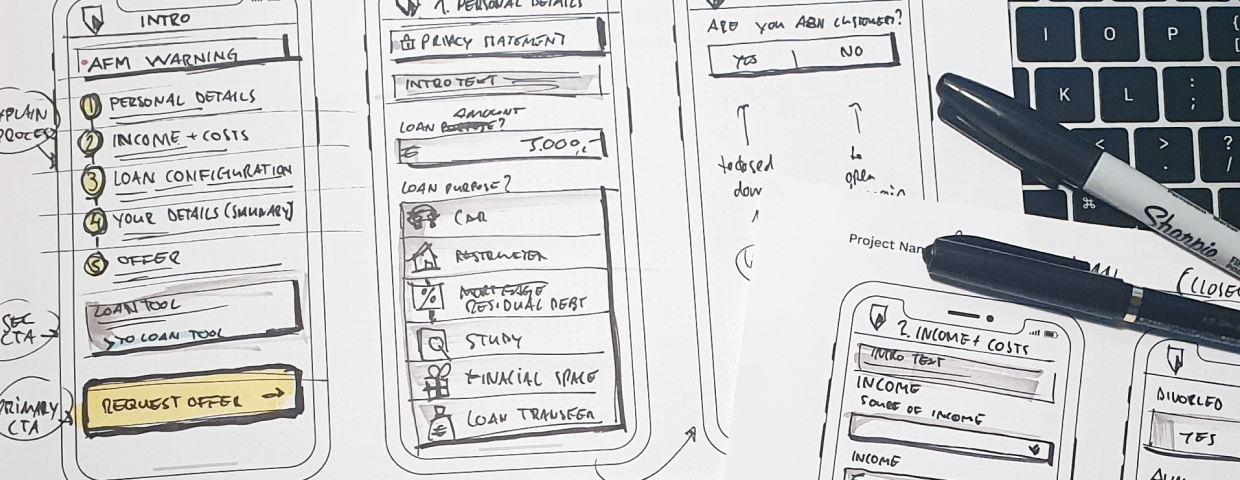

Design process

Data analysis: Discover churn points by teaming up with eCommerce department.

Expert Review: Map out any friction and restriction with Lead Designer of team Daily Banking.

User Interviews: Discover users' needs and thoughts about applying for a loan.

Solution Concepts: Hold a workshop with stakeholders to create concepts based on users' feelings, thoughts, and actions.

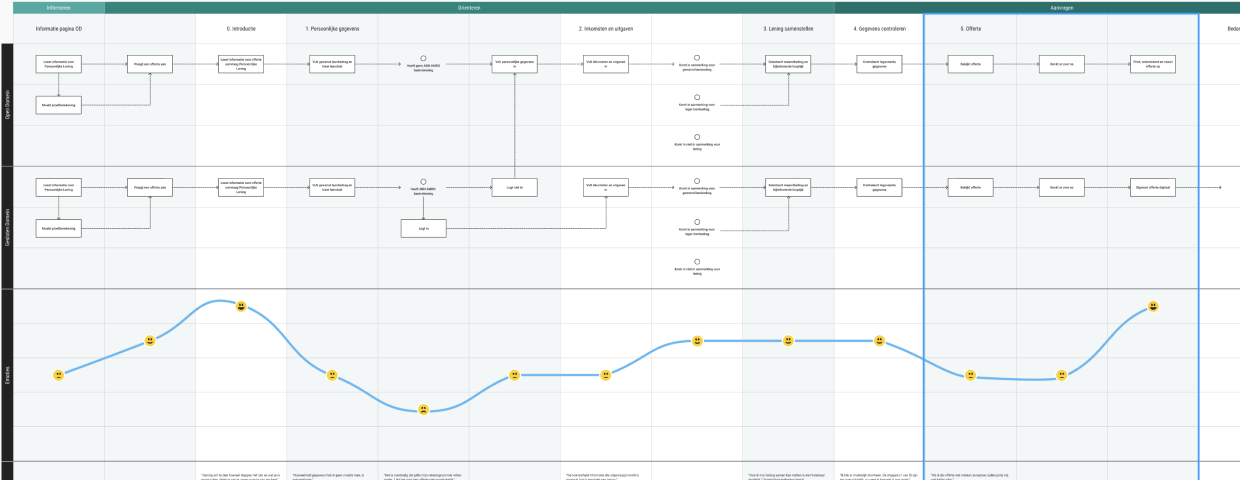

Journey Map: Define how the different types of users use the application flows.

Ideation & Validation: Test prototypes with users in UX lab, improve and come back.

UI design: Create responsive and detailed designs for the development team.

Topic research

How difficult do users it find to apply for a loan and how much and what information/details they are willing to give.

Scope

User: People with an MBO/HBO degree, non-financial profession, aging 20–55 years old, with basic banking/computer knowledge, have or haven't applied for a loan before, Dutch nationality (non-expat).

Market: ABN AMRO customers and non-ABN AMRO customers.

Findings

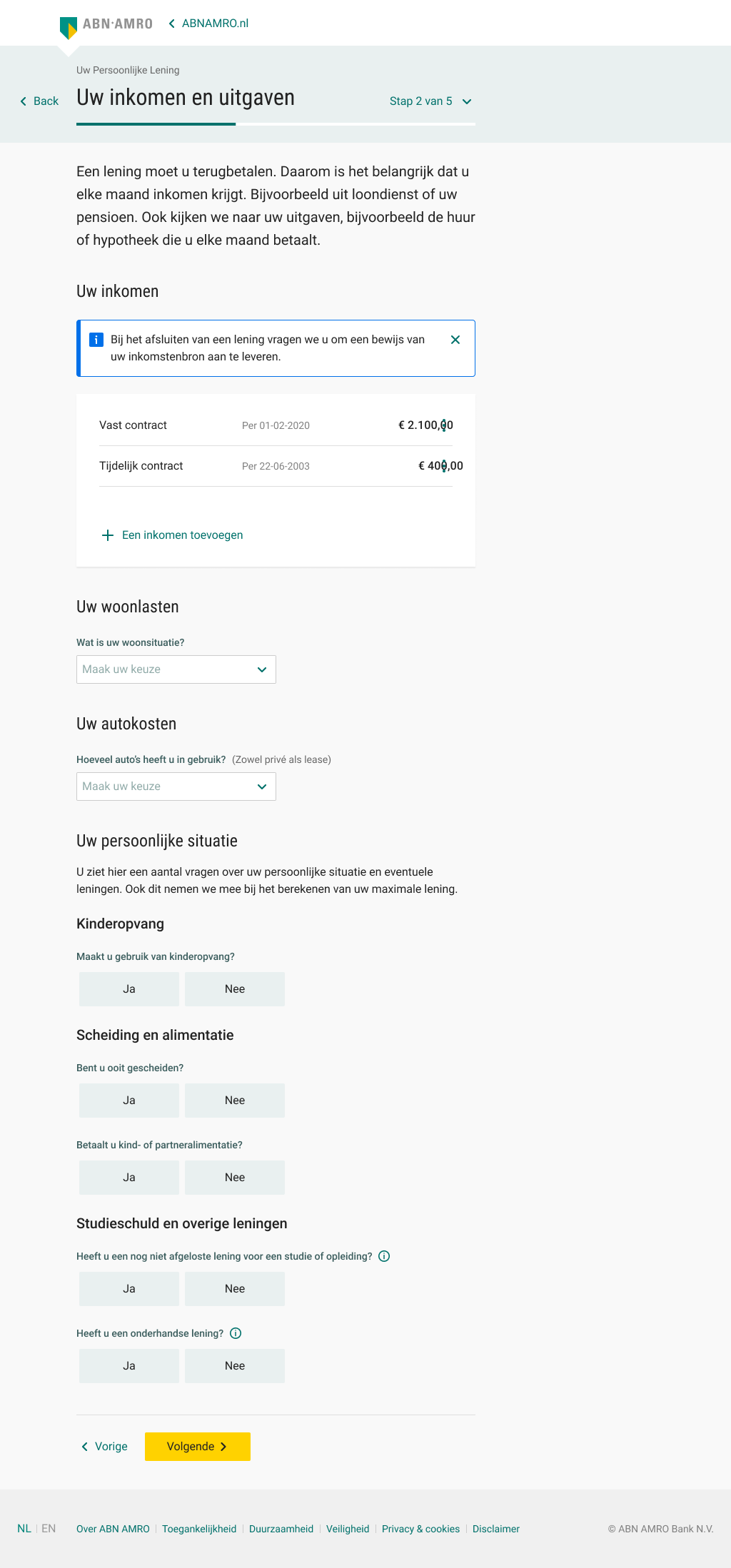

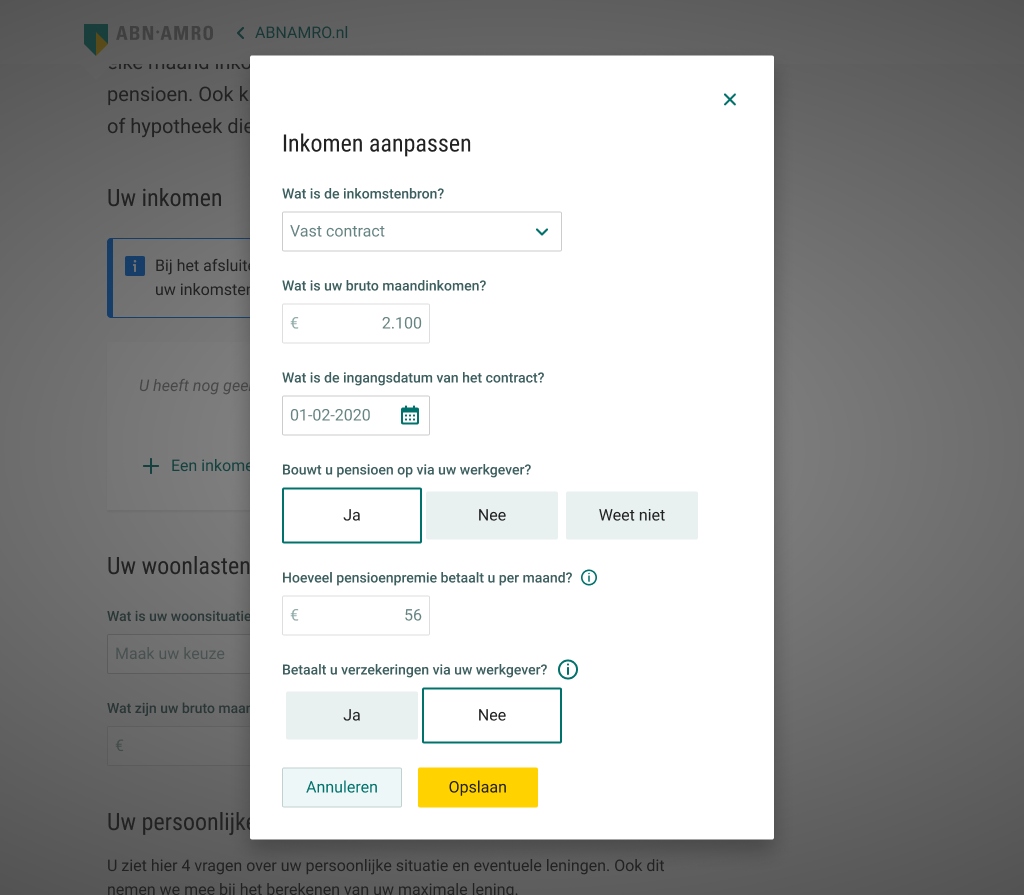

Users don't feel too much information is asked about them. They understand it is needed to apply for a loan. Giving them direct insight what a loan costs is useful to them.

Non-ABN AMRO customers prefer not to give their bank account number at an early stage.

ABN AMRO customers don't mind giving their bank account number at an early stage.

Design principles

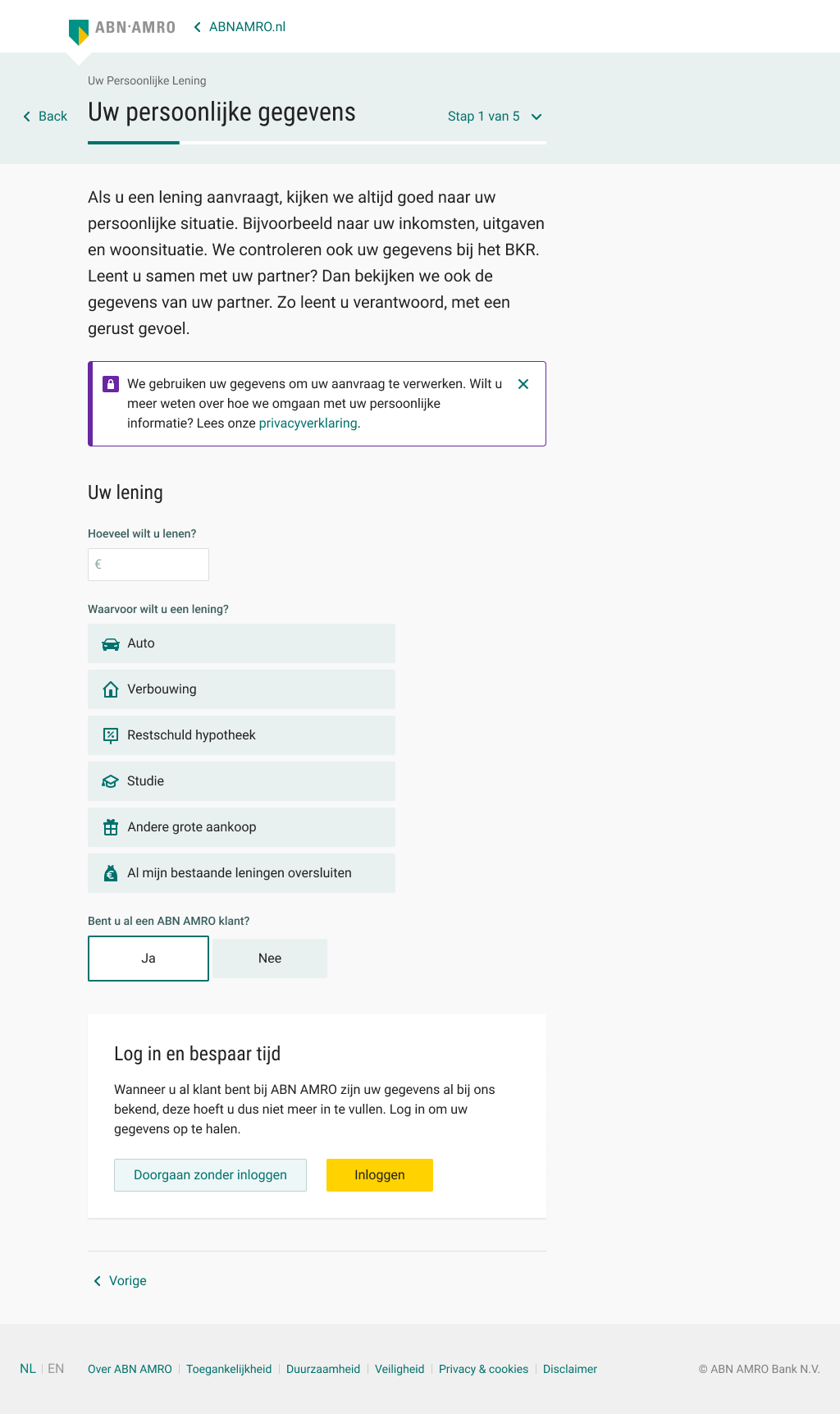

Simple: The application flow should be simple to use. The users do not need to learn a new pattern.

Polite: The design should be gainful and accessible to the users. There should be no insignificant distractions.

Unaggressive: The experience should be without any pressure. Don't push the users pushed towards a sale.

Results

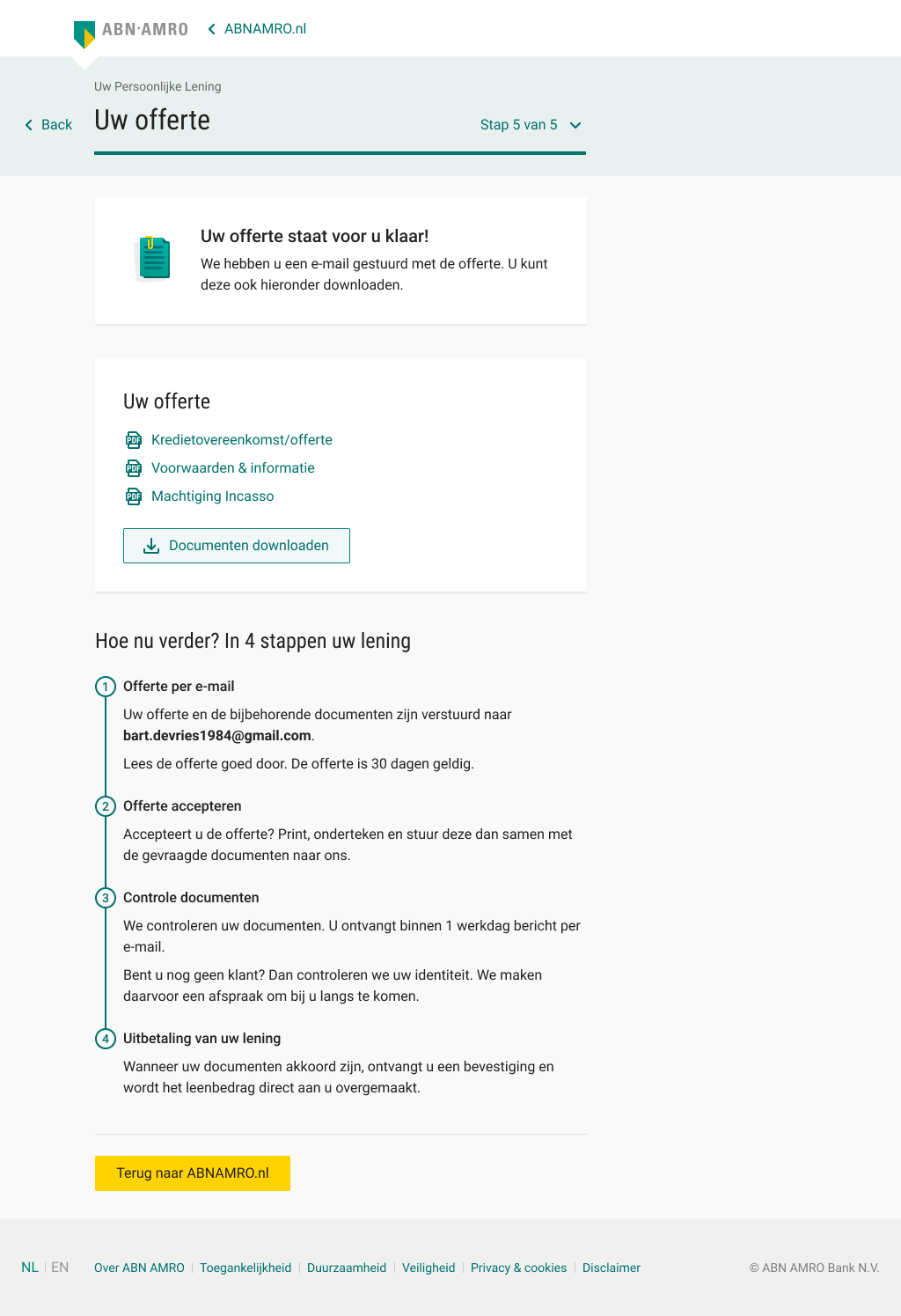

Users are able to request a Personal Loan offer the way that suits their needs best.

- Regardless whether the user is or isn't an ABN AMRO customer, the application flow and interface is simple and does not contain a learning curve.

- The adjustable monthly payment with corresponding duration, is adjustable to the user's preference.

- Asking for the bank account number is moved from the first to the last step. This causes the user to feel emotionally rewarded; give something to gain something.

- The Personal Loan offer is accurate, and the user is aware that its valid for 30 days. This way the user does not experience any pressure.